AI remains a top priority for business leaders worldwide in 2025, with a strong focus on reaping tangible results from their AI initiatives. This year, one in three companies globally is planning to allocate over $25 million to AI.

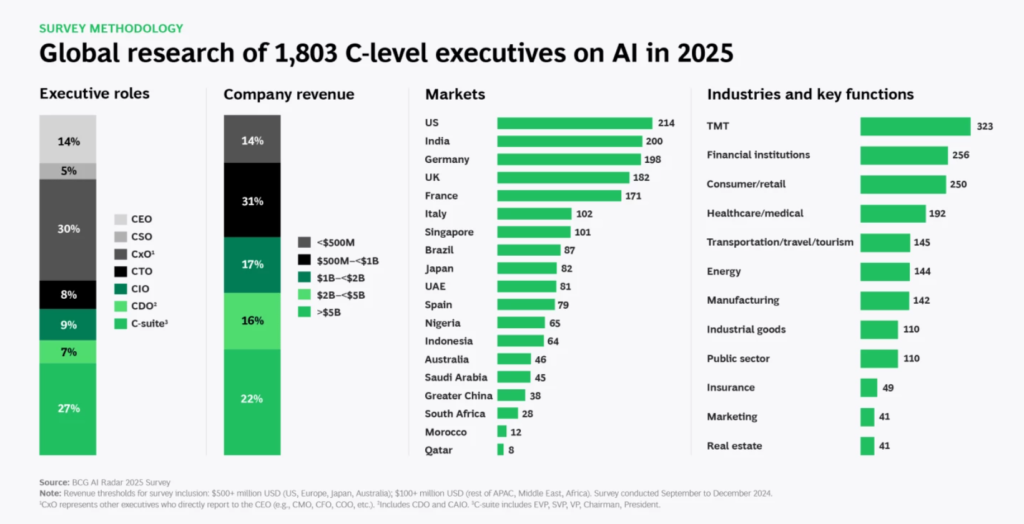

For the second year, Boston Consulting Group (BCG)’s AI Radar global survey has captured the mood of business executives when it comes to AI. The findings, released today, reveal both optimism and significant challenges in realising AI’s full potential. In the latest edition of the AI Radar report, titled From Potential to Profit: Closing the AI Impact Gap, BCG surveyed 1,803 C-level executives across 19 markets and 12 industries, including South Africa, Nigeria and Morocco.

“In my discussions with CEOs, it’s clear they are prioritising AI to drive productivity,” said Christoph Schweizer, CEO of BCG. “Our latest survey uncovers a crucial challenge: while 75% of executives rank AI as a top three strategic priority, only a quarter report meaningful value from their AI initiatives. Leading AI adopters have cracked the code on how to achieve impact by focusing on a targeted set of AI initiatives, scaling them rapidly, transforming core processes, upskilling their teams, and systematically measuring operational and financial returns. Many companies have an immense opportunity to close the gap between their ambitions and reality.”

How leading companies stay ahead of the pack

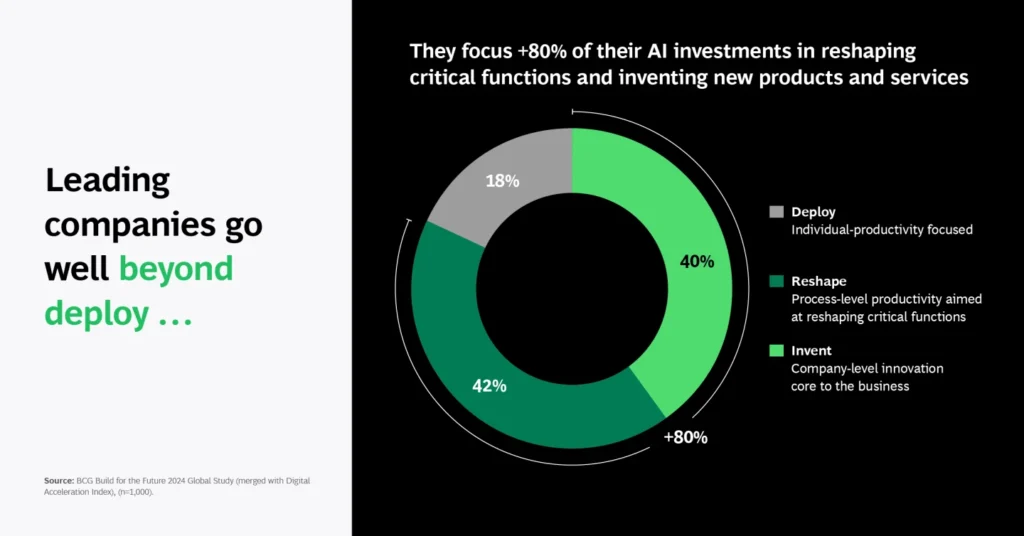

Leading companies allocate more than 80% of their AI investments to reshaping core functions and inventing new offerings, while other companies focus 56% of their AI investments on smaller-scale, productivity-focused initiatives. Leaders also set clear goals and track top- and bottom-line impact. However, 60% of companies surveyed are failing to define and monitor any financial KPIs related to AI value creation.

In Africa for instance, 35% of companies are not defining and monitoring any financial KPIs related to AI value creation. Sixty-two percent of these companies lack maturity in effective AI organisational change management, and 68% have indicated challenges hiring AI talent and upskilling their existing workforce.

Leading companies focus on depth over breadth, prioritising an average of 3.5 use cases, compared with 6.1 use cases for other companies. These companies anticipate generating 2.1 times greater ROI on their AI initiatives than their peers.

Autonomous agents: A key consideration in AI transformation worldwide

Agents are autonomous AI systems that achieve goals by using tools, analysing data, and working across systems—with minimal human input. While still in the early days of deployment, 67% of executives are considering autonomous agents as part of their AI transformation, with optimism around agents consistent across geographies.

At least 65% African companies surveyed have shown optimism about the role of AI agents moving into 2025, either exploring AI agents or viewing them as playing a central or complementing role in their AI transformation. African executives see talent and AI as complementary across all regions: 19% see AI taking the lead, but humans keeping oversight; 66% see AI and humans collaborating with complementary roles; and 15% are prioritising human talent and using AI only when necessary.

Only 7% of executives anticipate AI automation will lead to an overall decrease in headcount

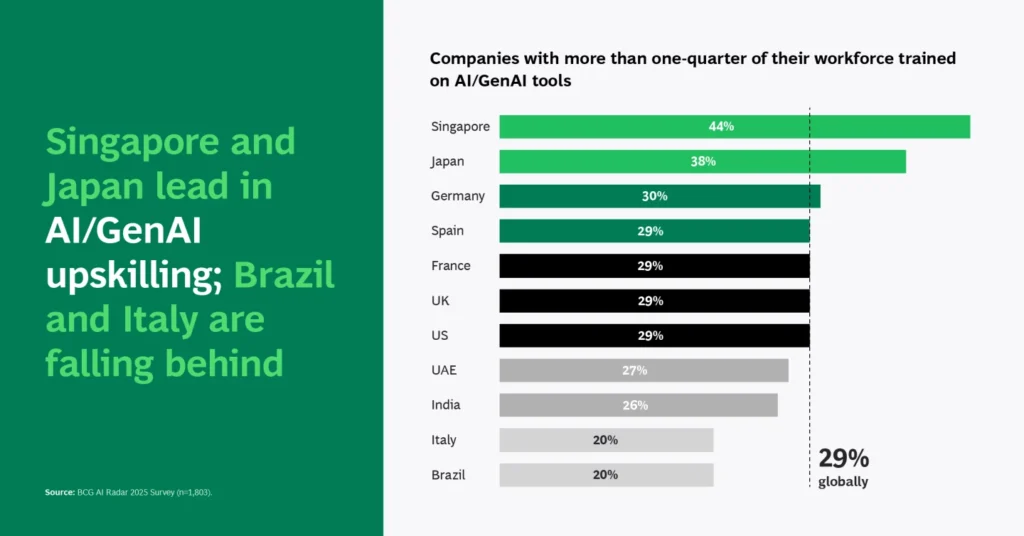

Sixty-eight percent of executives globally anticipate maintaining their current workforce size, focusing on enhanced productivity and upskilling existing talent to meet AI demands. That contrasts with the fact that fewer than one-third of companies have upskilled even a quarter of their workforce—an improvement from last year, but still far from the level needed to help employees feel secure in adapting to a technology often perceived as a threat to jobs.

In Africa, the report shows that only 6% of executives expect AI to lead to job losses. And, interestingly, 37% of these executives say that they see significant value from AI. This is supported by the finding that 86% of African companies are planning to increase tech investments in 2025, pushing for a more disruptive usage of AI, prioritising investments in higher-impact areas.

Asia-Pacific (34%) and Africa (31%) lead in AI/GenAI upskilling, while the Middle East (27%) and South America (20%) are falling behind.

Meanwhile, 17% of executives globally expect AI to reshape the workforce by introducing new roles to replace redundant ones. Eight percent foresee AI driving an increase in headcount, while only 7% predict a reduction in workforce size due to AI automation.

“Successful leaders adopt the 10-20-70 framework to unlock AI’s business potential, allocating 70% of their efforts to transforming people, processes, and culture; 20% to data and technology; and just 10% to algorithms,” said Sylvain Duranton, global leader of BCG X. “However, two-thirds of companies face significant challenges in reimagining workflows, driving cultural change, recruiting talent, and upskilling their workforce. Ensuring the success of AI initiatives requires disciplined execution, a relentless focus on value creation, and a workforce ready to adapt and thrive in a rapidly evolving environment.”

About Boston Consulting Group (BCG)

Founded in 1963, and with offices in over 50 countries, BCG’s diverse, global team comprising of 30 000 plus people bring deep industry and functional expertise and a range of perspectives that provide clients with management consulting solutions. Through its transformational approach aimed at benefiting all stakeholders, BCG empowers organisations to grow, build sustainable competitive advantage and drive positive societal impact. For more, go to www.bcg.com.

BCG is well established in Africa, with offices in: Cairo, Casablanca, Johannesburg, Lagos, and Nairobi, bringing together a team of nearly 600 collaborators. For more about BCG in Africa, go to www.bcg.com/Africa.

Share via: