By Paul Calvey, Partner Financial Services, Head of South Africa, Oliver Wyman

The recent JSE segmentation initiative is a positive step towards making the exchange more accessible to small and medium-sized enterprises (SMEs). SMEs are critical to the economic growth of South Africa, thus fostering greater access to finance is key to enabling their growth.

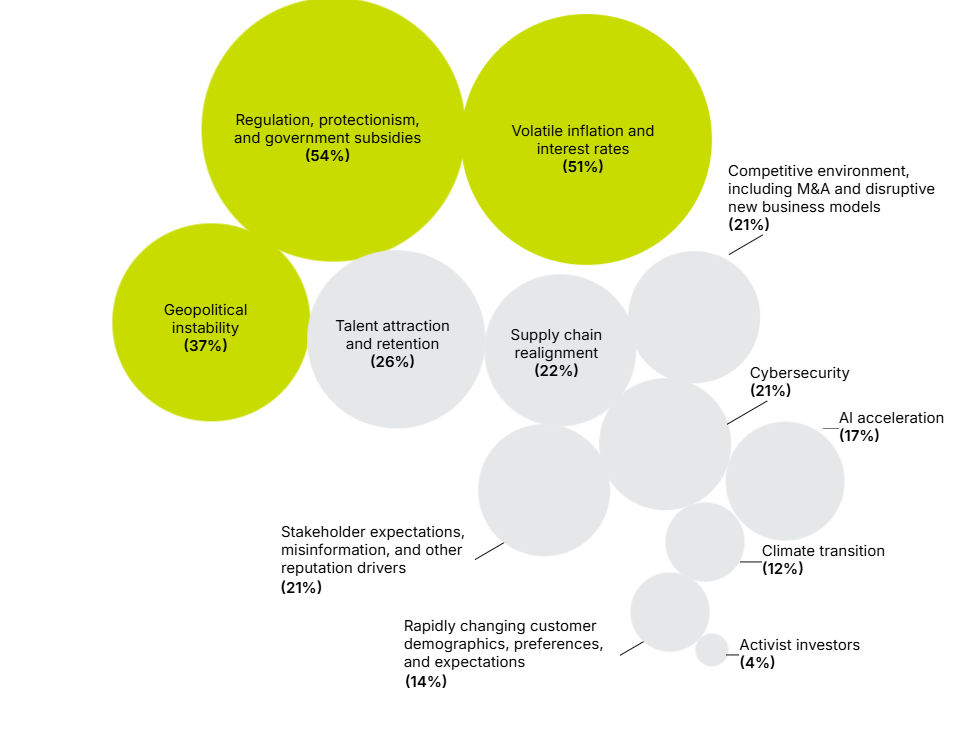

Oliver Wyman’s report, “The New Growth Agenda: How CEOs are Navigating Emerging Shifts in Geopolitics, Trade, Technology, and People,” based on a survey of CEOs from NYSE-listed companies, found that 54% of executives anticipate public sector regulation and improved government subsidies to be major enablers to business growth. The study also identified key challenges for growing businesses, including talent attraction and retention, increasing competition, and access to cost effective financing solutions. This underscores the necessity for SMEs aspiring to list on the JSE to understand the current market disruptors outlined in the report.

To succeed and continue to grow, SMEs will require diverse support in areas such as financial advisory services, tailored financial products, mentorship, and networking opportunities with industry experts. These resources will enable SMEs to build relationships with potential partners and investors, and, in some cases, advocate for policy changes or regulatory adjustments that foster SME growth.

This is a significant announcement in support of local businesses, but growing SMEs will need the backing of various structures to assist them in enlisting on the JSE.

Share via: